In the world of electronic filing, timing and precision are paramount. Recently, we had the opportunity to assist the IRS in resolving a critical issue.

The Problem: The 2024 Leap Year Glitch

Every four years, February has an extra day, February 29. While most systems account for this leap year phenomenon, IRS systems were not recognizing this date on its employment forms 941 using Schedule B. Therefore, liability amounts reported on February 29 were being rejected, causing confusion and delays for taxpayers and the IRS alike.

Our Solution

When we noticed a pattern of rejections for electronic returns with liability amounts reported on February 29, we quickly took action:

Our swift action not only prevented future disruptions but also ensured taxpayers could file their returns without facing unnecessary rejections. This collaboration highlights our dedication to providing top-notch electronic filing solutions and our ability to solve complex technical challenges efficiently.

Employers must choose between filing their employment tax return on paper or electronically (e-file). Here are the facts!

Paper filing takes 25 days: returns must be mailed. 94% of first class mail arrives within 3 days, If not lost or damaged. The time needed to complete and file a Form 941 is 22.5 hours which includes recordkeeping, learning about the law and preparing, copying, assembling and mailing the form to the IRS. The IRS takes an average 21 days to process a return. COVID-19 continues to cause delays on processing returns filed on paper for up to 6 months.

Electronic filing takes less than 2 hours: returns don't need to be mailed. The time needed to complete and file an electronic return can be 30 seconds for a zero return to no more than 30 minutes for a complex return. This is because all calculations are done automatically. IRS acknowledgments take minutes to complete.

The error rate on paper returns is 21%: returns must be prepared by hand. All calculations are subject to errors. Due to COVID legislation, there are now more data fields requiring calculations than the total number of fields in an actual Form 941.

The error rate on electronic returns is 0.5%: software completely eliminates the calculation nightmare.

Paper returns can't receive acknowledgments from the IRS.

Electronic returns receive acknowledgments within minutes after transmitted.

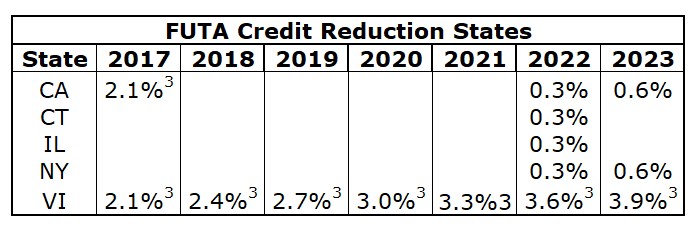

The Federal government levies a tax, called FUTA, on employers covered by a state’s Unemployment Insurance (UI) program.

The standard FUTA tax rate is 6.0% per employee on the first $7,000 of wages subject to FUTA reduced by a general credit of 5.4% per employee. The result is a net FUTA tax rate of 0.6% (6.0% - 5.4% = 0.6%) per employee, or a maximum annual tax of $42.00 ($7000 * 0.6% = $42) per employee.

The result of being an employer in a credit reduction state is a higher tax due on Form 940, for example, an employer in California in 2025 would compute its FUTA tax per employee (assuming the full tax credit is in place) by increasing the general tax of 0.6% ($7000 * 0.6% = $42) by the credit reduction rate of 1.2% ($7000 * 1.2% = $84) for an effective FUTA tax rate of 1.8% ($7000 * 1.8% = $126) for the year. This $84 additional tax per employee may seem like a small amount, but it can add up for larger employers that have many employees. Any increased FUTA tax liability due to a credit reduction is considered incurred in the fourth quarter and is due by January 31 of the following year.

For 2025, the U.S. Virgin Islands and NY are credit reduction states. Any employers that are subject to the credit reduction will need to pay their additional tax by January 31, 2026.

Understanding the credit reduction process. The funds from the FUTA tax create the Federal Unemployment Trust Fund, administered by the United States Department of Labor (DOL). Some states take loans against this Trust Fund if they lack the funds to pay UI benefits for residents of their states.

If a state has an outstanding loan balance on January 1 for two consecutive years and does not repay the full amount of its loans by November 10 of the second year, then the full FUTA credit rate of 5.4% for employers in that state will be reduced until the loan is repaid. This reduction will cause employers to owe a greater amount of tax.

The reduction schedule is 0.3% for the first year the state is a credit reduction state, another 0.3% for the second year, and an additional 0.3% for each year thereafter that the state has not repaid its loan in full. Additional offset credit reductions may apply to a state beginning with the third and fifth taxable years if a loan balance is still outstanding and certain criteria are not met.

DOL runs the loan program and announces any credit reduction states after the November 10 deadline each year.

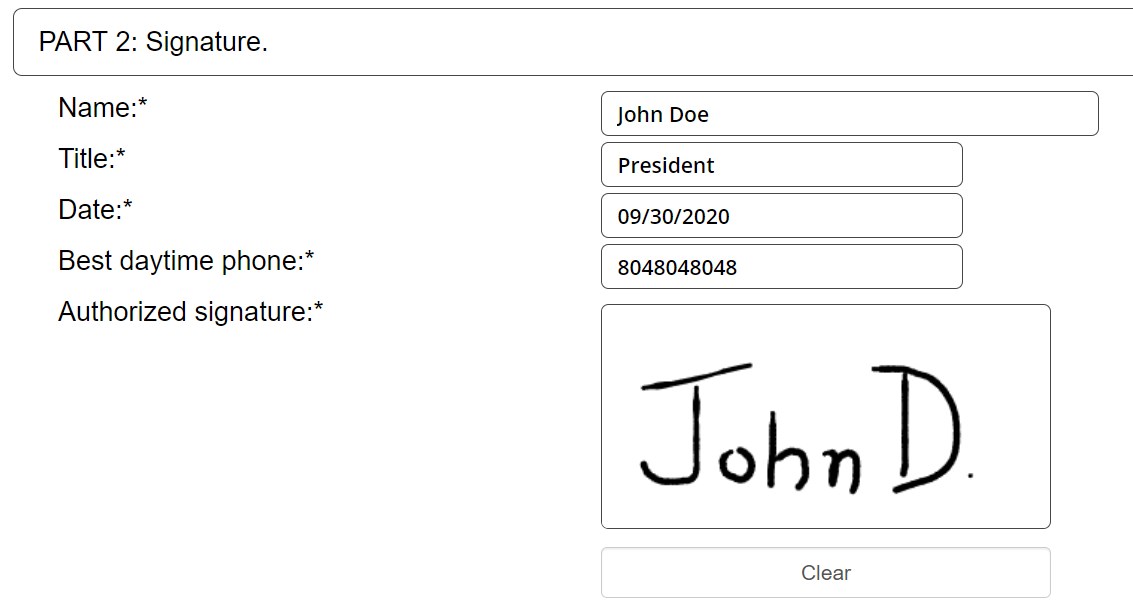

An electronic signature is a legal way to get approval on electronic documents or forms. It replaces a handwritten signature and increases the efficiency of virtually any process.

As with any tax return submitted to the IRS on paper, an electronic tax return must be signed by an authorized signer, an ERO and a paid preparer, if applicable. The IRS MeF system requires taxpayers and providers to use specific signature methods for signing electronic returns such as the Practitioner Personal Identification Number (PIN) method, Scanned Form 8453 Signature method, Reporting Agent PIN method and the Online Signature PIN method. Each of these methods requires specific forms to be attached to the return and must follow certain steps required to sign the return electronically.

Form 8879-EMP Practitioner PIN Signature method: This is TaxMe's preferred signature method and can only be used if the taxpayer uses an ERO. Taxpayer chooses a five-digit, self-selected PIN as their signature. Taxpayer can authorize the ERO to input this number in the software or must input physically directly into the software. The PIN number cannot be all zeros. Form 8879-EMP must be completed by the ERO and must be retained by both the ERO and the taxpayer for 3 years from the return due date. If a paid preparer is involved, the ERO is responsible to include the required information in the return. The paid preparer should also keep a copy of the return approved and signed by the taxpayer. Form 8879-EMP should not be mailed to the IRS unless the IRS requests a copy.

Scanned Form 8453 Signature method: It involves signing a peper Form 8453-EMP and attaching it electronically to the e-filed return as a PDF document. This document is a jurat, it has the same legal effect as if the taxpayer had actually and physically signed the return. This form can authorize an ERO, a Transmitter or an ISP to send the return to the IRS. The form must be retained by the taxpayer and should not be mailed to the IRS.

Form 8655 Reporting Agent PIN Signature method: A reporting agent is an accounting service, franshiser, bank or other entity authorized to prepare, sign and electronically file employment forms for taxpayers. Reporting agents sign all electronic returns they file with a 5-digit PIN signature. The reporting agent PIN is issued through the IRS e-file application process. Reporting agents can transmit returns directly or use a third-party Tranmitter. Reporting agents must submit Form 8655 to the IRS prior to updating or submitting an IRS e-file application. Form 8655 gives the tax professonal authority to sign the client's return with their reporting agent's 5-digit PIN.

Online Signature PIN method: This method is available for an authorized individual to act for an entity in legal and/or tax matters and is held liable for filing all 94x returns and making all 94x tax deposits and payments. It authorizes an entity to file no more than 5 returns per year. This method does not give authorization to file bulk returns or returns for other businesses. To become an Online e-Filer, the applicant must first complete the 94x PIN Registration Process using commercial software. Registration can take up to 45 days to process. The PIN assigned to the participant consists of a 10-digit number which is used to electronically sign an employment tax return.

A provider is an entity authorized by the IRS to participate in IRS e-file. To become a provider, the entity must submit an application, meet eligibility criteria and pass a suitability check.

An entity identifies its e-file activity by selecting the appropriate provider option in the IRS e-file application. Each provider option entails a different role and may have different responsibilities that relate specifically to the e-file activity of the firm. The IRS may take up to 45 days to approve an e-file application.

E-File providers can be classified as: Electronic Return Originators (ERO's), Intermediate Service Providers, Transmitters, Software Developers, Reporting Agents, Online Providers or Large Taxpayers. These roles are not mutually exclusive. Therefore, providers can operate under multiple roles. For a full list of IRS e-File providers click here.

Electronic Return Originators (ERO's) originate the electronic submission of a return to the IRS. The ERO is usually the first point of contact for most taxpayers e-filing a return. There are about 180,000 entities classified as ERO's in the United States. Most entities apply to be ERO's because this category allows them to receive taxpayer information and pass it on to a transmitter. An ERO can be the accounting firm or the H&R Block office in your neighborhood.

Software Developers develop software that formats electronic return information according to IRS e-file specifications. There are about 700 approved software developers in the United States.

Transmitters send the electronic tax data directly to the IRS. The IRS accepts transmissions using a variety of telecommunication protocols. There are approximately 41,000 approved transmitters nationwide.

There are only about 530 entities across the nation classified as ERO's, Transmitters and Software Developers and only about 30 entities listed annually in the IRS website as Modernized e-File (MeF) Providers. See IRS list here.

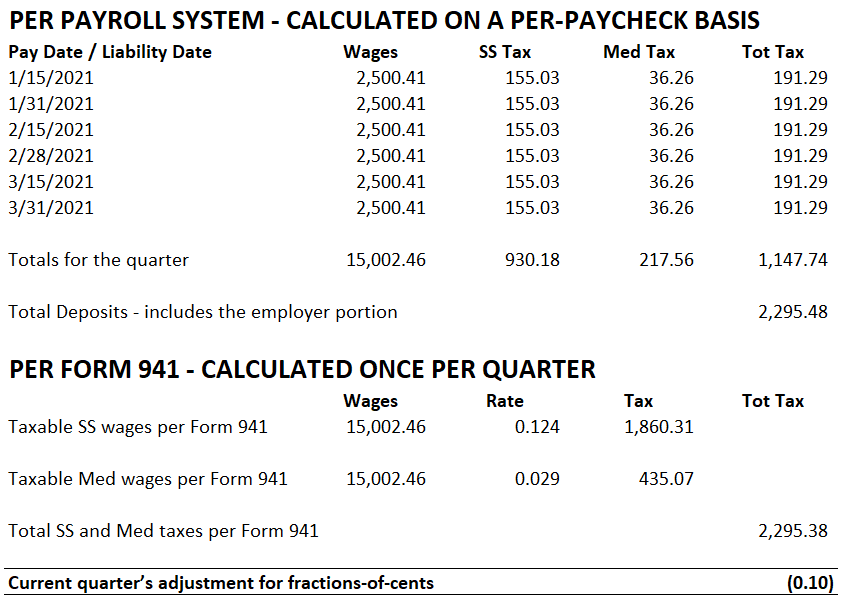

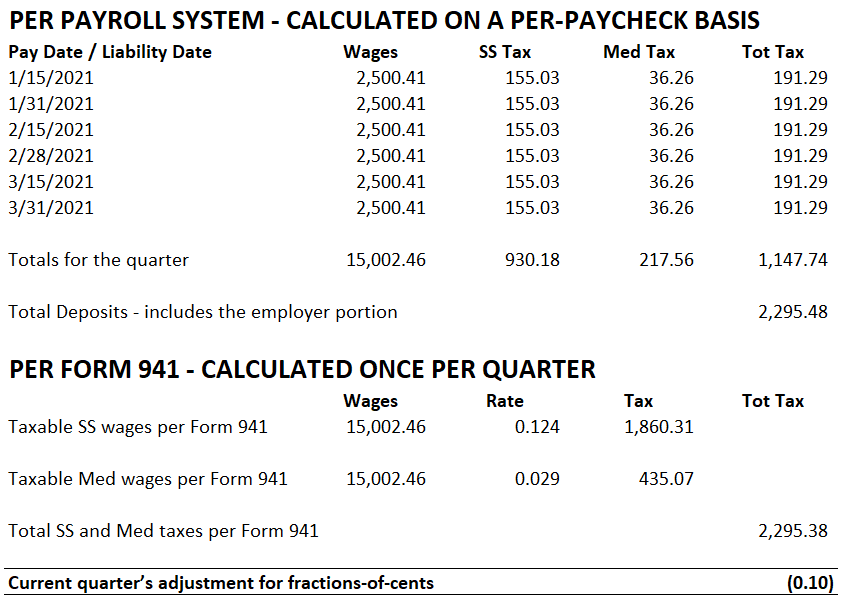

Rounding differences between your payroll system’s calculations and the amounts calculated on form 941 is what the IRS refers to “fractions-of-cents” adjustments.

These differences represent amounts calculated on a per-paycheck basis compared to those same amounts calculated on a quarterly basis. Below is a detail explanation that will help you understand this adjustment.

The following example explains the adjustment that may be necessary for ONE employee only. Keep in mind that having more employees that fall in a similar situation may affect the adjustment up or down.

Generally, all systems are designed to calculate amounts by rounding the result to 2 decimal places i.e. if the result is 155.02542, systems will give a result of 155.03. Notice in the chart below that the taxes calculated on a per-paycheck basis for Social Security and Medicare are higher than those calculated once every quarter. To arrive at the total adjustment, you will need to multiply the amounts of Social Security and Medicare taxes calculated on a per-paycheck basis times 2 (employee and employer portion) and compare that amount to the calculated amounts once during the quarter on form 941.

The IRS actually allows rounding off cents to whole dollars. However, you must round all amounts and if you are adding amounts you must include cents before rounding. Systems are not designed to do this.

As a first time recipient, we are honored to be recognized and featured on the cover, by HR Tech Outlook Magazine as one of its Top 10 Payroll Solutions Providers 2022.

HR Tech Outlook is an enterprise technology magazine. It is the go-to resource for senior-level HR leaders and decision-makers to learn and share their experiences with products/services, technologies and HR technology trends. The magazine caters to 139,000 qualified subscribers.

Click the image to download a pdf reprint of the cover story, or click here to check out the entire article and see the other nine winners, which include ADP and Paychex.

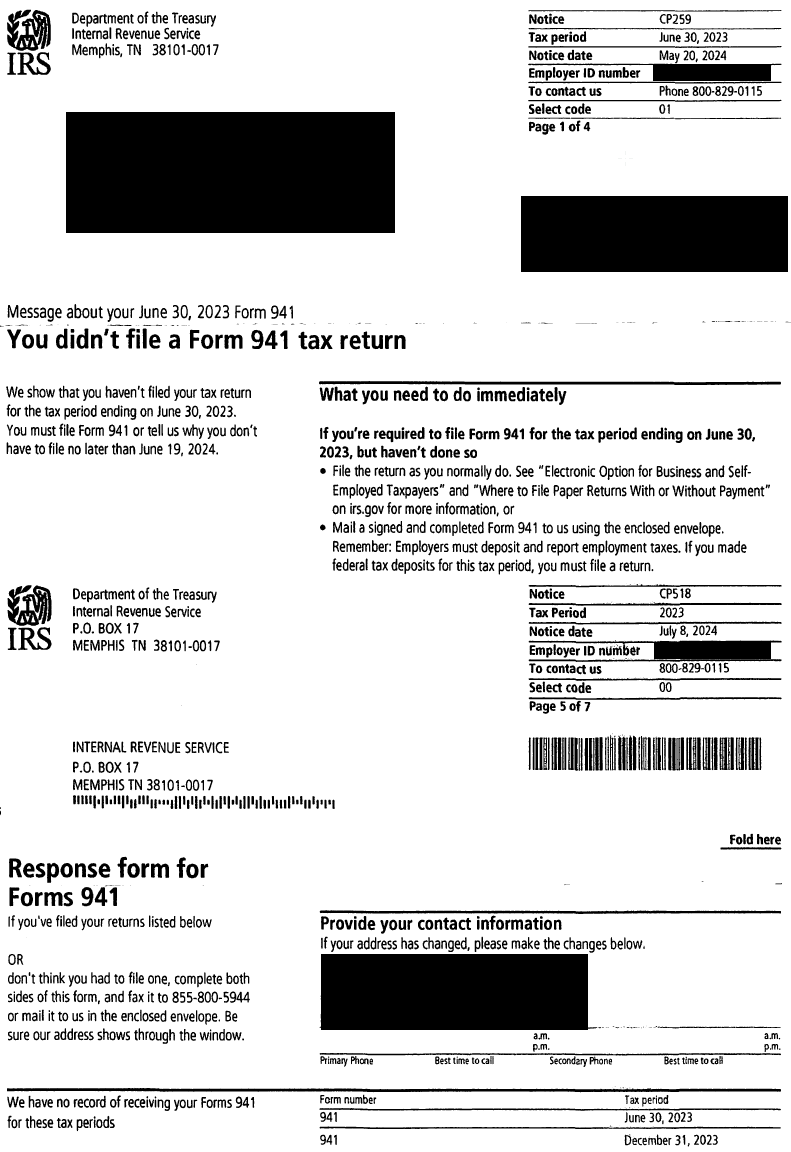

As an employer, receiving an IRS notice indicating a failure to file a return after receiving initial acceptance can be confusing and concerning.

The Systems Involved:

Notices You Might Receive:

Recommended Action:

Here’s what you should do if you receive a Notice CP259 or CP518:

Conclusion: While these erroneous notices can be frustrating, responding with the correct documentation will help resolve the issue. At TaxMe, we strive to assist our clients with any issues they encounter.

An Employer Identification Number (EIN), also known as a Federal Tax Identification Number, is essential for identifying a business entity.

Businesses can apply for an EIN online, by fax, phone, or mail, depending on their convenience.

For exempt organizations, it is crucial to be legally formed and to file all required returns or notices for three consecutive years. The IRS presumes compliance when an EIN is applied for, assuming the organization meets these requirements.

To prevent misuse, the IRS limits EIN issuance to one per responsible party per day. If you suspect someone is using your business name or EIN for fraudulent activities, promptly complete and submit Form 14039-B, Business Identity Theft Affidavit. This form is necessary if you receive an IRS rejection notice for a previously accepted return, a notice about a tax return or Forms W-2 you didn't file, or a balance due notice you don't owe.

Remember, an EIN cannot be canceled once assigned but can be closed if no longer needed. To close your business account, send a detailed letter to the IRS including the complete legal name of the entity, the EIN, business address, and reason for closure. Note that accounts cannot be closed if there are outstanding tax liabilities or returns due.

It is critical that business owners correctly determine whether the individuals providing services are employees or independent contractors.

Generally, you must withhold income taxes, withhold and pay Social Security and Medicare taxes, and pay unemployment tax on wages paid to an employee. You do not generally have to withhold or pay any taxes on payments to independent contractors.

If you are a business owner hiring or contracting with other individuals to provide services, you must determine whether the individuals providing services are employees or independent contractors. In determining whether the person providing service is an employee or an independent contractor, all information that provides evidence of the degree of control and independence must be considered.

Facts that provide evidence of the degree of control and independence fall into three categories: Behavioral Control, Financial Control, and Type of Relationship.

Businesses must weigh all these factors when determining whether a worker is an employee or independent contractor. Some factors may indicate that the worker is an employee, while other factors indicate that the worker is an independent contractor. There is no “magic” or set number of factors that “makes” the worker an employee or an independent contractor.

Facial recognition is gaining momentum due to a large reduction in error rate, faster algorithms and cheaper licensing contracts.

Facial recognition is now used for real time screening and access control including applications that interconnect smart phones, vehicles, thermostats, etc. Despite all these advances, most applications still require usernames, passwords and other authentication methods.

There is no doubt facial recognition has improved many computer processes. However, this technology by itself has been proven to be inaccurate. Take Apple’s Face ID biometric solution, for example, Apple’s current Security Safeguards policy states: “the probability that a random person in the population could look at your iPhone or iPad Pro and unlock it using Face ID is approximately 1 in 1,000,000.”

The chances to crack a six character password containing lower and upper cases is 1 in 57 billion. This means that if anyone can devise a brute force attack on all iPhones, with access to a large database of face images, it will take fractions of a second to hack all iPhones that use Face ID in the planet.

TaxMe devised a vector that allows users to use their image and two inherent identifiers to access their data. We completely eliminated the standard online account registration process, no usernames or passwords or 2-step authentication are needed to use our products. We own the most sophisticated access technology in the field of electronic filing.

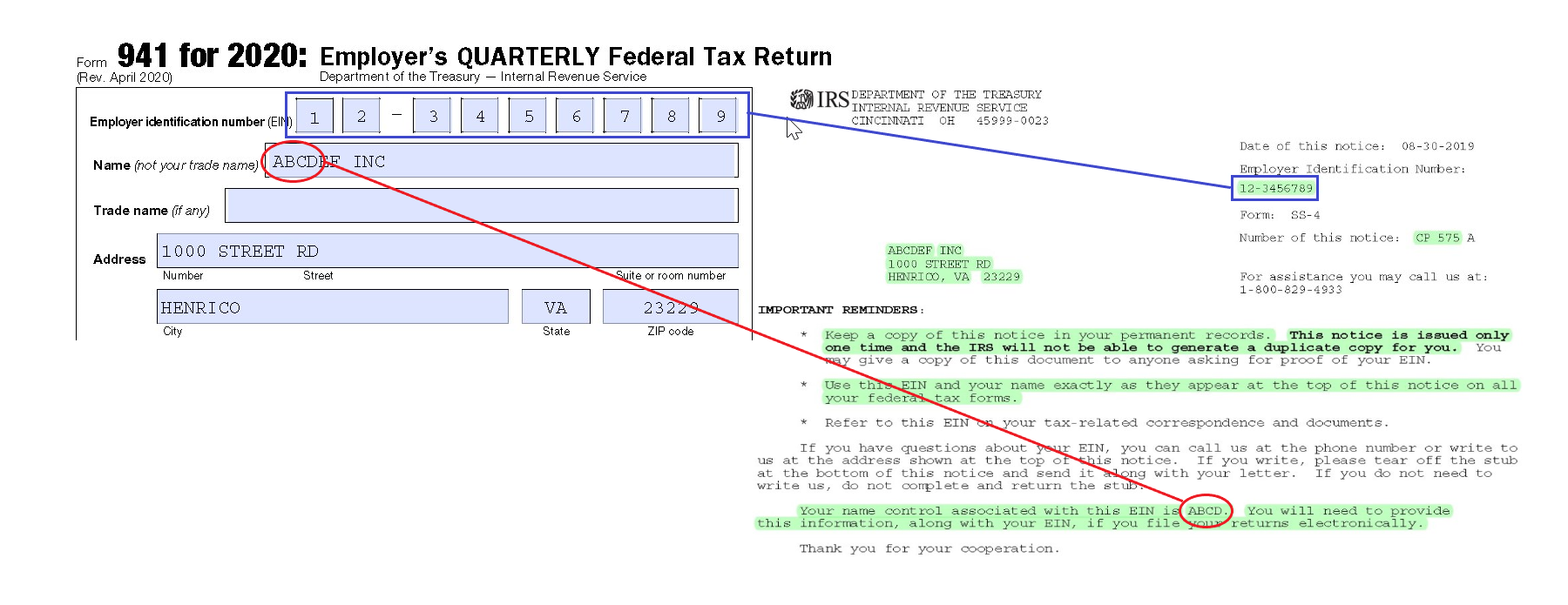

If you don't type your business name or EIN correctly when you e-file an employment tax return, your return will be rejected.

Name Control matching is a process in IRS Modern Electronic Filing (MeF) that verifies the Employer Identification Number (EIN) and Name Control of the filer against the IRS’s National Account Profile (NAP) database. Each data item in the NAP system is required to identify a specific taxpayer so that a filed tax return can be processed correctly.

Name Control mismatch is one of the most common causes for the rejection of returns in MeF so it is critical to ensure that each return submitted has the correct Name Control.

When a business appplies for en EIN, the IRS issues Notice CP 575 which contains the Name Control assigned to the business.

Generally, the Business Name Control is derived from the first four characters of the business name and consists of up to four alpha and/or numeric characters. The Name Control can be fewer than four characters, but not more. Blanks may be present only at the end of the Name Control. The ampersand (&) and hyphen (-) are the only special characters allowed in the Name Control.

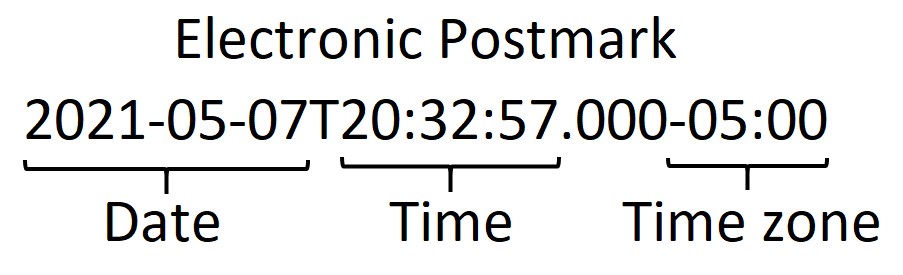

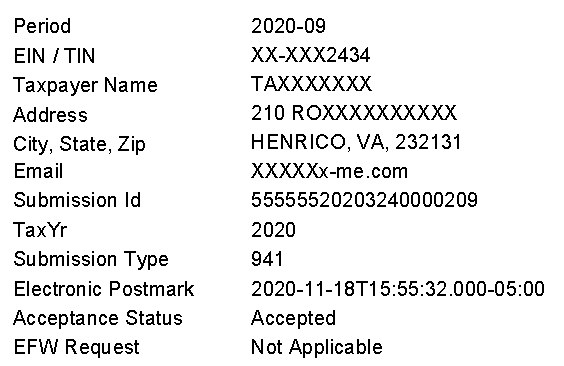

As a Transmitter and an ERO, TaxMe is able to provide an electronic postmark to taxpayers who e-file employment tax returns.

TaxMe creates the electronic postmark bearing the date and time, in the Eastern time zone. Taxpayers need to adjust the electronic postmark to the time zone where they reside to determine the postmark’s actual time.

Example: If TaxMe provides an electronic postmark with a time in the Eastern time zone but the taxpayer resides in the Pacific time zone, the taxpayer must subtract three hours from the postmark time to determine the actual postmark time (Pacific time zone).

If an electronic postmark is created on or before a prescribed deadline for filing but the return is received by the IRS after the prescribed filing deadline, the return will be treated as filed on the electronic postmark date if received within two (2) days of the electronic postmark. For a return to be treated as filed on the electronic postmark date, all requirements for signing the return must be met.

As a Transmitter, TaxMe is authorized to provide an electronic postmark. TaxMe retains a record of each electronic postmark until the end of the calendar year and provide the record to the IRS upon request. TaxMe transmits all employment tax returns that received an electronic postmark to the IRS within two days of receipt.

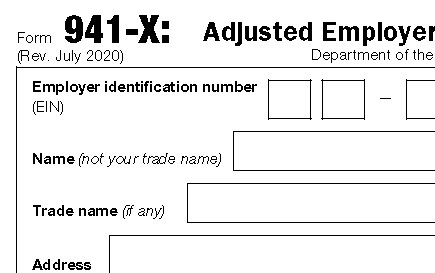

The IRS now accepts electronic versions of amended employment tax forms.

When you discover an error on a previously filed Form 94x, you must correct that error using Form 941-X, 943-X, 944-X 945-X or by checking the Amended Return box of Form 940. Do not file Form 941-X to correct the number of employees or federal tax deposits.

Form 941-X: Generally, Form 941-X must be filed within 3 years starting April 15 of the following year of the year of the return. For example, if you are amending any quarter of a 2024 form 941, you can file Form 941-X by April 15, 2028. In this example, the IRS starts the clock on April 15, 2025. This is called "period of limitations".

Also, if you are correcting overreported amounts and are filing form 941-X in the last 90 days of a period of limitations, you MUST use the claim process. You can’t use the adjustment process. If you’re also correcting underreported amounts, you must file another Form 941-X to correct the underreported amounts using the adjustment process and pay any tax due.

Amended Form 940: To amend or make a change to an already filed Form 940, check the Amended Return box in the top right corner of Form 940, fill in all the amounts that should have been on the original form, sign the form and attach an explanation of why you are amending your return.

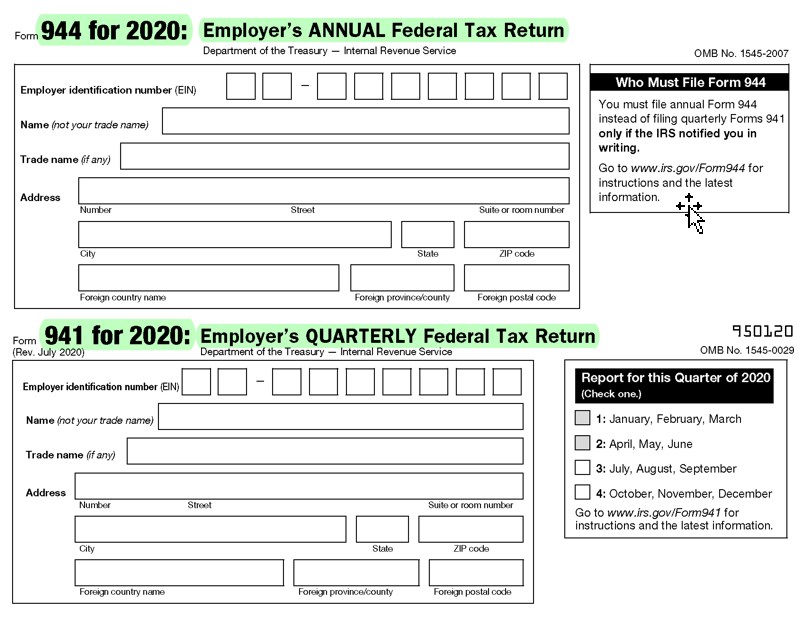

These two forms are not interchangeable. The employer should never flip-flop between the two forms on their own.

The employer should always file according to their designated filing requirement, which is set by the IRS when applying for an EIN on Notice CP 575. If you are currently required to file Form 944 but estimate your tax liability to be more than $1,000 or vice-versa, you may be eligible to update your filing requirement.

To request a change, you must send a written request, postmarked by March 15 of the current year or call the IRS by April 1 of the current year. The IRS will send a written notice if it changes your filing requirement.

Form 941, Employer's Quarterly Federal Tax Return. This form allows employers to report employment tax liabilities each quarter. If the IRS advises the employer to file Form 941 quarterly, they must do so.

Form 944, Employer's Annual Federal Tax Return. This form allows employers to report employment tax liabilities once a year, instead of quarterly and must be filed when employers owe $1,000 or less of employment taxes per year. This form can’t be used unless an employer receives official IRS notification that they are eligilble to use this form.

The IRS will reject any employment form (94x family of forms) that is transmitted before the end of the reporting period.

When you e-file an employment form, it must meet certain rules stablished by the IRS or the form will be rejected. One rule specifically, does not allow e-filing of early filed returns.

An early filed return may be batched together with other returns for electronic filing. If an early filed return is transmitted to the IRS before the end of its reporting period, TaxMe will receive an IRS rejection acknowledgment and produce an error message.

Important: If TaxMe identifies a return as “Early Filed”, regardless of being transmitted to the IRS or not, it will not affect the overall processing of the return. When a return is submitted early, TaxMe will either automatically queue the return until the date it can be transmitted, or re-transmit your return at no additional cost to you.

Business owners can simplify things by filing payroll taxes electronically. E-file software performs calculations and populates forms and schedules.

Benefits of filing forms electronically: It saves time, It's secure and accurate and the filer gets an email to confirm the IRS received the form within 24 hours.

Employers submitting the forms themselves will need IRS-approved software. There may be a fee to file electronically and the software will require a signature method. Employers can file via an Electronic Return Originator (ERO). An ERO is the Authorized IRS e-file Provider that originates the electronic submission of a return to the IRS.

TaxMe is an Electronic Return Originator (ERO). An ERO originates the electronic submission of a return after the taxpayer authorizes the filing of the return via IRS e-file.

In 2020, the IRS began masking specific details of business tax transcripts in order to prevent identity theft.

This change was implemented two years after masking sensitive data on individual tax transcripts. TaxMe follows IRS masking specifications when producing IRS acknowledgments.

Below is a list of visible items in an IRS acknowledgment: Last four digits of EIN, SSN, Account numbers, and more.

A tax transcript is a summary of an individual or a business tax return, it is available after the IRS has processed a tax return. Tax transcripts may be used by tax professionals to prepare tax returns, represent clients before the IRS or by lenders and others for income verification purposes.

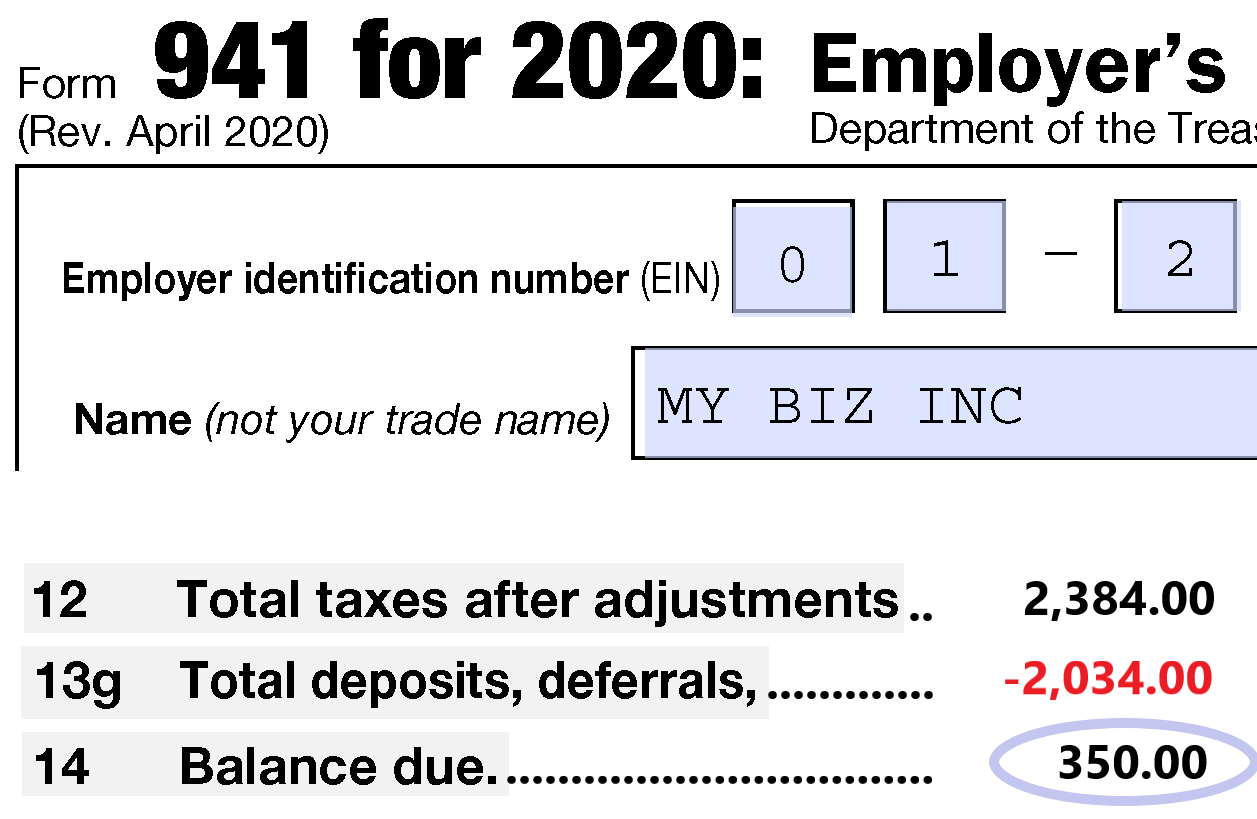

Taxpayers who owe additional tax when they file an employment tax return must pay the balance due by the original due date of the return.

Employment forms 941 are due April 30 for Q1, July 31 for Q2, October 31 for Q3, and January 31 for Q4. There are no extensions of time to file an employment tax return or pay a balance due.

Taxpayers have three choices when paying taxes: 1. Electronic Funds Withdrawal (EFW), 2. Electronic Federal Tax Payment System (EFTPS) and 3. Check or Money Order.

Electronic Funds Withdrawal (EFW): Balance due payments can be submitted at the time a return is filed. EFW payments require banking information and a signed consent statement. Once your return is accepted, your payment details cannot be changed.

Electronic Federal Tax Payment System (EFTPS): To use EFTPS, taxpayers must first enroll. This service is free and available year-round, 24/7 at EFTPS.gov.