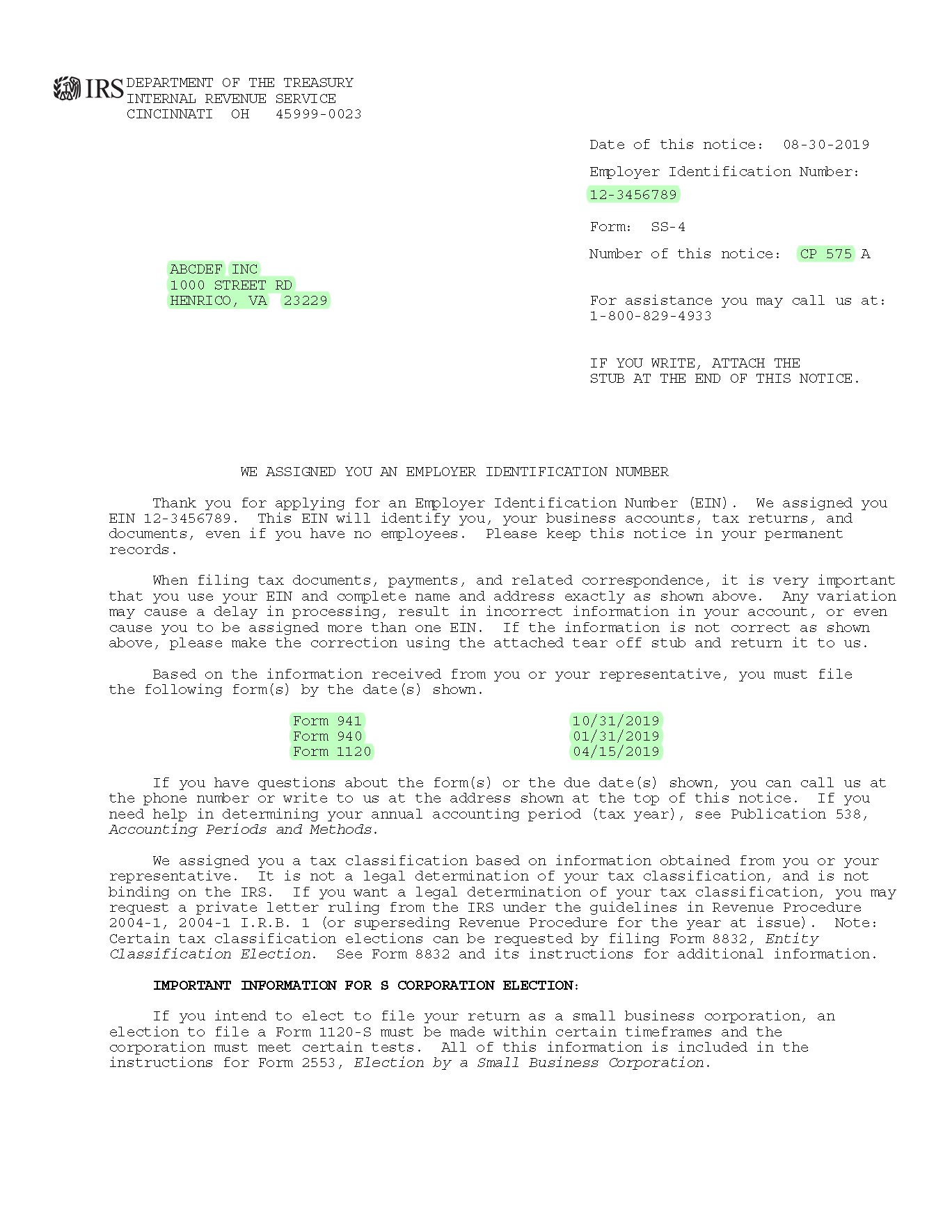

IRS Notice CP 575

A business applying for an EIN is required to complete Form SS-4 (Application for Employer Identification Number).

Notice CP 575 is an IRS document generated when a business is assigned an EIN.

Below is a list of possible situations where your Notice CP 575 becomes handy:

- When opening a new bank account, financial institutions will ask for proof of identification.

- Differentiating between Business Name and Trade Name. Sometimes taxpayers confuse the two when e-filing a tax return which will cause it to be rejected.

- All IRS correspondence will be delivered to the address shown on this notice.

- Notice CP 575 lists the federal tax forms required to be filed and their corresponding deadlines.

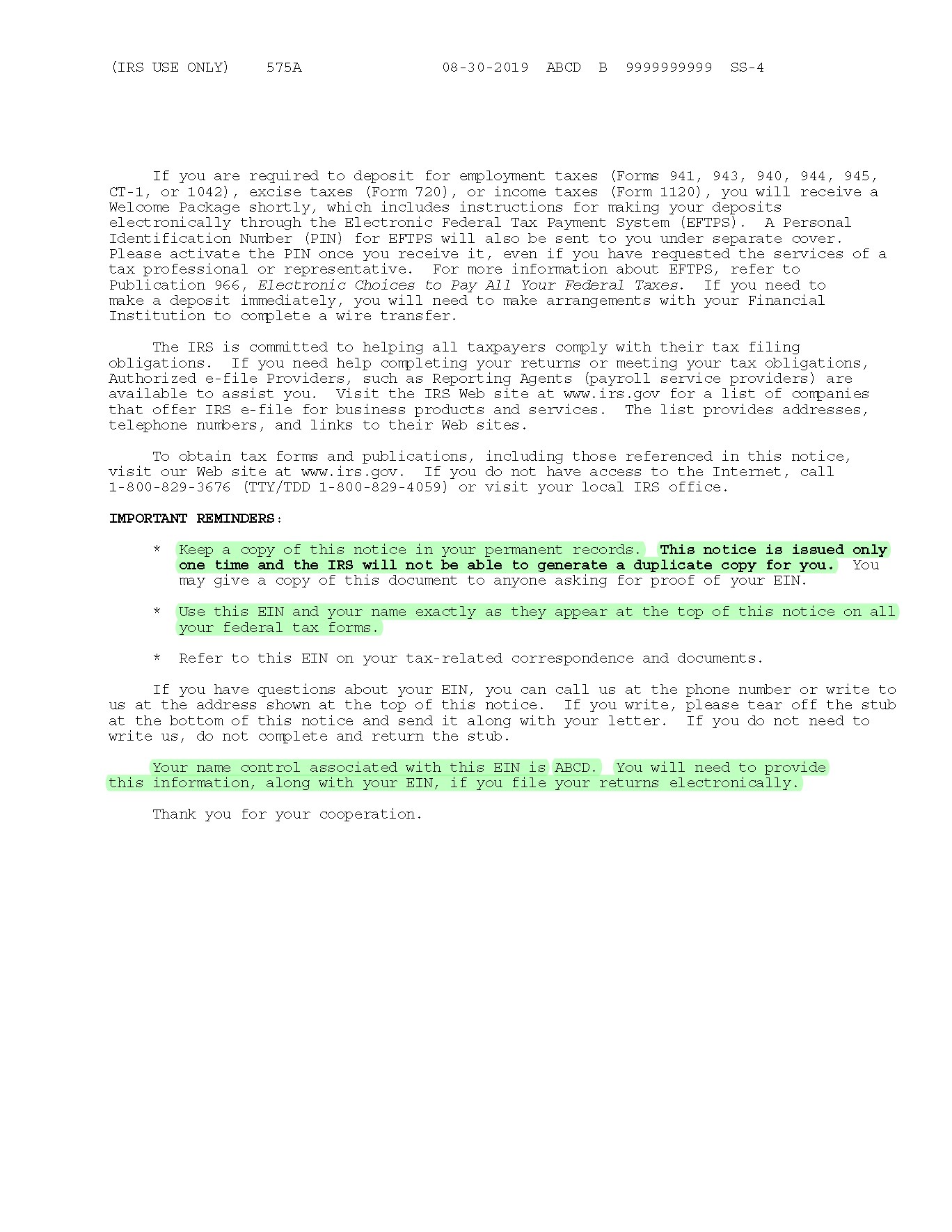

- NAME CONTROL. It generally results from the first 4 characters of the business name with certain variations (i.e. when the name of the business is too short or has special characters). When a federal return is e-filed, the IRS will match the name control against the EIN. If no match is found it will reject the return.

The images below show a sample CP 575 highlighted with some of the items listed above.

![]()

×